Voodoo Figure 4. The End of the Age of America

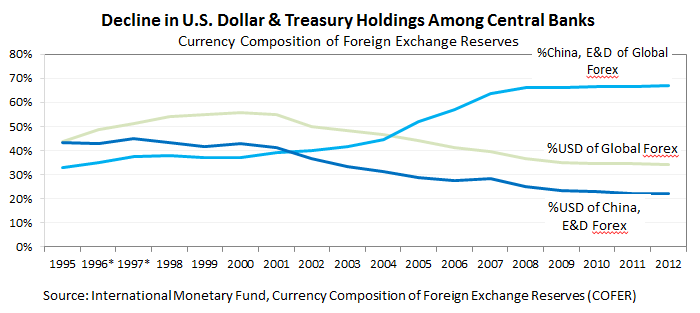

Emerging and developing economies have grown to account for about two-thirds of the world’s central bank holdings of foreign exchange reserves as their relative holdings of U.S. dollars have quietly gone in the opposite direction… Increasingly, bi-lateral trade agreements among other nations exclude the use of the U.S. dollar as payment for international trade, once the domain of the U.S. dollar as the world reserve currency. Other countries see what is unfolding in this country but it is unclear if the American public sees it. — Quantitative Easing 0-1-2-3∞ & The Federal Reserve’s Love Affair with its Banks and Mortgage Bonds: Levitating The Black Hole (Oct. 22, 2012)

These developments can be seen in Figure 1, as China is the primary driver of the group of emerging and developing (E & D) economies. Government central bank foreign exchange reserves (Forex), also call official international reserves, consist of foreign cash and bonds. In this context, think of Forex reserves as a component of a country’s ‘savings’ from production; part of the composition of savings are the currencies central banks hold, U.S. dollars being the world reserve currency, and to a lesser degree euros, yen, and pound sterling. The size of the Forex reserve and its composition of currencies may give an indication of a country’s growth and weighting of its import-export production, savings or indebtedness, its ability to influence exchange rates or confidence about currencies.

Voodoo Figure 1. Decline in U.S. Dollar & Treasury Holdings among Central Banks, 1995-2012

In just eight years from about 2000 to 2008, China in leading the E&D economies, nearly doubled its share of global central bank foreign currency reserves to now hold two-thirds of the world’s currency reserves ‘savings’ as seen in Voodoo Figure 1. In the U.S. by 2008, the worst banking and financial collapse in a century (perhaps a few) continues to unfold. From 1995 to 2012,

- China and the E&D economies reduced relative holdings of U.S. dollars by about half (slightly over 40% to 20%) quietly over the past 18 years, but a striking difference is

- advanced economies held on at about 60% of its Forex in U.S. dollars (not shown in the chart) as its share of global foreign currency reserves plunged from two-thirds to about one-third.

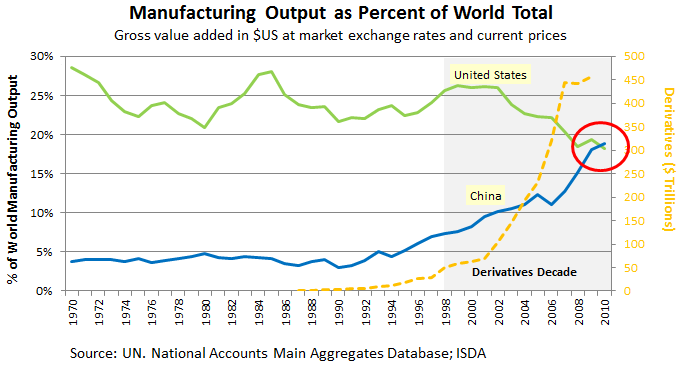

Let’s look at what is behind these rapid shifts from the two countries leading these changes, shown in Figure 1 to Figure 2. An important determinant of the increase in central bank foreign reserves is driven by the country’s productivity, so we look at trade. Countries trade in both goods and services but the focus is on manufacturing as the value of manufacturing goods accounts for over two-thirds of U.S. and over 90% of China’s exports in 2011. From the available data in Figure 2, for about 25 years China’s share of world manufacturing output appear dormant until about 1995, when it began to rise to match its growing share of global central bank Forex reserves (more detail in Figure 3).

Voodoo Figure 2. The Decade of Financial Derivatives of the Largest Member Banks of the Federal Reserve System: The Rise of China. The derivatives data from ISDA (IRS, CDS, currency swaps) is for illustration purposes and is incomplete, as there are over $1,000 trillion in notional derivatives outstanding. Following the collapse in 2008, there was a re-valuation of derivatives by the IMF and BIS and similarly a change in the valuation of bank balance sheets by FASB’s suspension of mark-to-market rule in 2009. QE & The Federal Reserve’s Love Affair showed the effects of FASB. Derivatives are financial contract instruments based on or whose value is ‘derived’ from the underlying value of an asset, at least that is the definition.