Today marks the second day of the United States’s expedited meeting with China “as they work out ways for the U.S.-led world order to make room for a China that is fast accruing global influence and military power” (Associated Press. May 21, 2013).

April-May, 2013: Orchestrated plunge in gold, silver. Stock “market” levitated. What the system does not have much of is gold, silver. Growing reports of shortage and major banks refusing to deliver physical gold belonging to clients; extended delivery delays; drainage of gold from London; ABN Ambro defaulted, refused to deliver gold but predicts a gold price collapse.

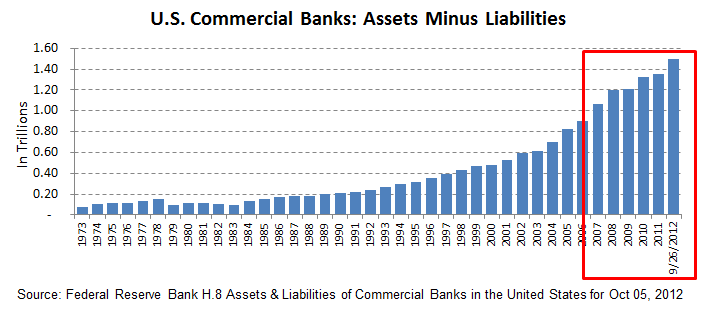

Consider a hyperinflation not in the traditional ways of the Weimars and Zimbabwes that printed currency with ink and paper, but in derivatives (a portion in above chart). Over $1,000 Trillion unprinted pretend ‘derivatives’ dollars that do not exist, mostly interest rate derivatives that hold together the interest rate structure. Inflation subdued? That depends on where asset prices would be (stock market – 401k-IRAs – bank balance sheets…) without suspending FASB’s accounting rule and printing money ‘QE’ 0-1-2-3∞ + ZIRP and multi-trillion dollar swaps.

Behind this kabuki theatre is history in the making. It is the U.S. dollar’s diminishing role as the international settlement currency for world trade (about $18 trillion merchandise trade in 2012) along with its implications. Since at least 2012, bilateral trade agreements among other nations have begun settling in non-U.S. dollars. Over the next few years, China’s economy will become the largest in the world, and with India (the people) and Russia lead the world in gold accumulation.

May 7, 2013: China announces aim of convertibility of the yuan in 2013. [Yuan]

May 7-8, 2013: G-20 Meets in Turkey: “Reinventing Bretton Woods” [Reinventing the gold standard…]

Developing and emerging economies led by China, now hold two-thirds of foreign exchange reserves among world central banks.

May 10-11, 2013: Unscheduled Meeting of G-7 (Britain, Canada, France, Germany, Italy, Japan and the United States) over the weekend in London. Federal Reserve Bank Chairman Bernanke absent. “ ‘It’s very rare for a G-7 to focus on financial regulation,’ one of the officials said, speaking on condition of anonymity”. Perhaps then, on the G-20’s meeting in Turkey which portends the re-entry of gold to anchor the new system. In the previous article, “Yes it is true: ‘Gold is dead.’” reports raise questions about how much gold, if any, is left at Fort Knox, which at its height vaulted about half of the gold holdings in the United States, half belonging to other countries.

May 21, 2013: : China’s President Xi to Meet with U.S. President earlier than expected, June rather than September

(AP). “The June 7-8 meeting at a retreat southeast of Los Angeles, announced Monday by the White House, underlines the importance of the relationship between the countries as they work out ways for the U.S.-led world order to make room for a China that is fast accruing global influence and military power.

President Xi has said China wants its rise to be peaceful…”

Preview to Last Section of Part II Subversion of the United States

“America will never be destroyed from the outside… it will be because we destroyed ourselves.”– Abraham Lincoln

To summarize, destroy its family, its traditions, and values – the foundations of its society. Why? Easier to control and condition the individual towards dependence and obedience to the supremacy of the state. These are the Communist International “Rules of Revolution” document found by the Allied forces in Dusseldorf, Germany after World War II. Yuri Bezmenov, Soviet KGB subversion ‘brainwashing’ expert-turned defector (Part I Ideological Subversion of the United States), could not vouch for the authenticity of the document, but he confirmed they are near verbatim to Soviet ideological subversion in his 1984 book, Love Letter to America (26MB in parts 1, 2, 3 due to size limits). One of these rules is “Always preach democracy, but seize power as fast and as ruthlessly as possible” (p. 17).

It raises an interesting question: Were the German people also subverted, ‘brainwashed’ to accept totalitarian-fascism as the wealth behind the U.S. foundations and investment banks financed the rise of Hitler? As the Telegraph reported, these were the same foundations that funded covert operations to corral nations into the European Union following the end of World War II as several generations in the United States had been successfully ‘brainwashed’ towards the same ideology by the 1960s. Incidentally around this time as we see in Part II some of the most famous experiments in psychology were conducted in the United States to assess the level of obedience of the adult population, findings that shocked the researchers…

In 1908 when the Carnegie Endowment began its operations, the Trustees discussed a specific question: “Is there any means known more effective than war, assuming you wish to alter the life of an entire people?” and concluded there was “no more known effective means than war”. In 1909, the Endowment (Foundation) raised a second question: “How do we involve the United States in a war?” and concluded, “We must control the State Department.”

During WWI, the Trustees of the Carnegie Endowment dispatched a telegram to President Woodrow Wilson cautioning him to see to it that the war did not end too quickly. These were uncovered in the minutes of the Carnegie Endowment meetings during the congressional investigation in the 1950s that was halted by the White House and both sides of Congress. The director of the congressional investigation stated the Dictaphone tapes of these Endowment memorandums and meeting notes are held in the archives of the U.S. House of Representatives and within the Carnegie’s archives.

(Confirmed communist spy Alger Hiss was president of the Carnegie Endowment and David Rockefeller joined the Board at Hiss’s “invitation”. Hiss was forced to step down due to the investigation, which takes us to Covington & Burling – Yes, the law firm that created the legal foundation for MERS that expedited mortgage securitization at the center of the 2008 collapse that led to the nationwide suspension in home foreclosures in 2010 as the major banks, Fannie Mae and Freddie Mac used forged and defective documents to foreclose raising questions of broken chain of title on homes across the nation from their MERS.)

In 1917, President Woodrow Wilson appointed Robert S. Brookings to the War Industries Board (WIB) whose function was to connect business to government. President Wilson named Brookings chairman of the War Board’s Price Fixing Committee, which negotiated the maximum prices on raw industrial materials for producers during World War I. U.S. Major General Smedley Butler in his book War is a Racket (1935) cited U.S. Steel whose founder was J.P. Morgan as the leading beneficiary of World War I. J.P. Morgan combined U.S. Steel with the Carnegie Steel Company. U.S. Major General Butler wrote “War is a racket. It always has been… Only a small ‘inside’ group knows what it is about…” and ‘the American soldier follows the flag’.

Robert S. Brookings founded the Brookings Institution in 1916, one of the oldest think tanks in Washington D.C. In the previous article, “The European Union (EU) ‘Dream’ Wasn’t Even European,” the largest contributors to the Brookings Institution are the Ford Foundation and Rockefeller Foundation, Bill & Melinda Gates Foundation, and John L. Thornton of Goldman Sachs. Nearly a century later, the Brookings Institution is where Robert Rubin and Lawrence Summers – with former Federal Reserve Bank Chairman Alan Greenspan – who were instrumental in the proliferation of derivatives that collapsed the U.S. economy in 2008, gather to promote economic growth and health care, the last area to be taken under centralized control. A correction may be required when 401k and retirement plans are nationalized.

In 1976, Congressman Larry P. McDonald wrote in the book introduction,

“The drive of the Rockefellers and their allies is to create a one-world government combining supercapitalism and Communism under the same tent, all under their control. … Do I mean conspiracy? Yes I do. I am convinced there is such a plot, international in scope, generations old in planning, and incredibly evil in intent.”

On June 2, 1983 W.A. Harriman, elder statesman of the Democratic party, flew to Moscow as a private citizen taking along a State Department translator for a confidential chat with Yuri Andropov, General Secretary of the Communist Party of the Soviet Union (Sutton). Not even the U.S. President or Vice-President had met with the new leader of the Soviet Union. Sutton noted the interesting timing as about three months later on September 1, 1983 Congressman McDonald was killed with 269 other passengers when Korean Airlines 747 was shot down by the Soviets. Yuri Bezmenov believed Congressman McDonald was the target, premeditated at the highest levels (1983 video).

Yuri Bezmenov’s former boss was head of Soviet KGB Yuri Andropov who became General Secretary of the Soviet Union with whom W.A. Harriman held a private meeting. A few weeks after the downing of Korean Airlines 747, the New York Times reported former President Nixon denied the Soviet’s claims that he canceled his seat on the same flight that killed Congressman McDonald (“Moscow asserts Nixon canceled seat on Korean 747.” NYT Sept 25, 1983). [Henry Kissinger was President Nixon’s national security advisor, whose order of importance at the White House was to respond first to calls from Nelson Rockefeller, then movie stars and celebrities, then the U.S. President (Woodward & Bernstein. (1976). The Final Days p.193). Kissinger-Rockefeller and the Iranian people’s billions are in Part II].

Who were the most vocal voices that assailed the communist hearings? The same W.A. Harriman, elder statesman of the Democratic party and partner in Brown Brothers Harriman & Co., the oldest investment bank in the United States. Another was Senator Prescott S. Bush – patriarch of 41st and 43rd U.S. presidents – Harriman’s partner at the investment bank for over 40 years, both financiers of Hitler’s Third Reich. It does not end there…

Sutton (1986, updated 2002) identified Brown Brothers Harriman & Co., J.P. Morgan, and Covington & Burling among their conduits over the past century. There is a London counterpart…

These series of previews and excerpts are assembled in Part II Subversion of the United States. Consider what mosaic emerges. “Too big to bail”-“Too big to fail”-“Too big to jail” banks. Catchy, yes. Just overlook the mechanisms that maintain the interest rate structure, the Treasury bond market, stock market… Consider the top U.S. attorney general who refused to investigate mortgage fraud in 2008 and the new SEC head, as both shared the same revolving door that leads back to Standard Oil tankers being manned by Nazi officers.

In Part I, back in the 1930s Premier Mussolini praised “President Roosevelt’s new plan for coordination of industry follows precisely the lines of Fascist cooperation… Dictatorships are inevitable.” (“Mussolini Sees World Driven Toward Fascism.” New York Times June 4, 1933) what America’s leading socialist, Norman Thomas described as “in effect what President Roosevelt has done has been to lay the foundation for an immense structure of State capitalism.” (“Is the New Deal Socialism? A Socialist Answers.” NYT June 18, 1933). What might this look like? The chart may remind some of the Hegelian dialectic over the left and right in the United States.

Bezmenov (1983 interview on subversion of the United States): “Situation is NOT under control. System is disgustingly out of control.”