More broadly there seems to be a confluence of events as the American public and its treasury are being plundered in parallel to once-sovereign countries of the Eurozone, bound together by debt and much of the over $1,000 trillion in derivatives (money that does not exist). All based on a quasi-private Federal Reserve monetary system that prints dollars (or euros) from nothing in exchange for savings earned and countries as collateral for the privilege of its debt. Smoke plumes rise in the Middle East. From my first post, Welcome to EconomicsVoodoo.com! (October 17, 2012)

The banking and financial crisis emerging in September 2008 is often called a global financial crisis, but to be more precise the data point to a crisis of the Western central banks. I referenced euros previously, so this is the euros companion to Quantitative Easing 0-1-2-3∞ & The Federal Reserve’s Love Affair with its Banks and Mortgage Bonds: Levitating The Black Hole. QE 0-1-2-3 is incomplete as concurrently the Federal Reserve Bank also entered into $10.06 Trillion in dollar ‘loans’ liquidity swaps with foreign central banks that we examine in Section I. Why QE $10T as we look at a few of Europe’s largest banks in Section II, which leads us to the $1.25 Trillion naked reasons behind the Federal Reserve Bank’s Quantitative Easing I purchase of phantom agency mortgage bonds that we revisit more closely in Section III.

What the Federal Reserve Bank and its largest member banks, some European banks did with the $1.25 trillion Federal Reserve MBS purchase program in 2009 “QE 1” may leave some in disbelief. Consider an example from this MBS purchase program, the Federal Reserve gave a handful of banks $57.7 billion for a $600 million mortgage bond issued in 1980s . For a moment, recall that quantitative easing or ‘QE’ is the printing of dollars (or euros) in digital or paper form beyond the capacity to earn them through the production of goods and services. The banking and financial crisis in 2008 is often attributed to subprime mortgages, but it is not the mortgage loans per se, but the opaque $7 trillion or so mortgage derivative bonds (presumably containing mortgage loans) and $62 trillion in credit default swaps (CDS) ‘insurance’ derivatives built into the bonds and their insurers that make losses exponential.

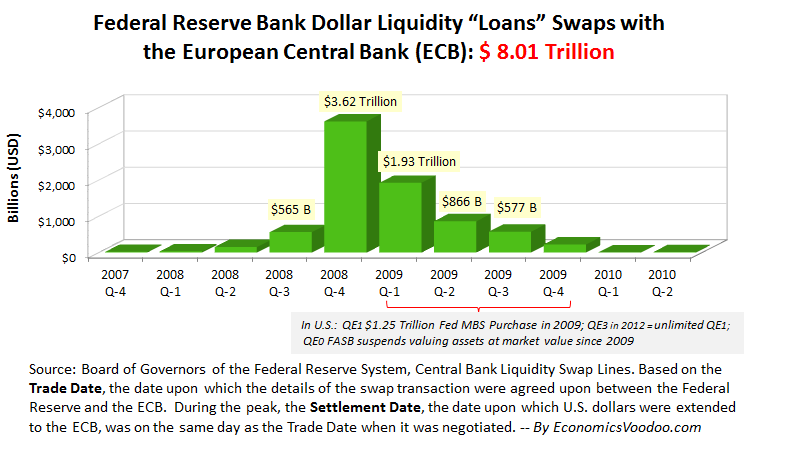

I. Federal Reserve Bank & European Central Bank’s $8.01 Trillion Dollar-Euro Swaps

At the height of the crisis in the United States, the Federal Reserve Bank extended $8 trillion of the $10 trillion in dollar liquidity swaps to the European Central Bank through the Federal Reserve Bank’s creation of the Central Bank Liquidity Swap Lines [Data] as shown in the Voodoo Swaps Chart 1 below; swap agreements were with 14 foreign central banks. These dollar liquidity swaps in essence were loans, though not technically called loans, but merely a swap or an exchange of currencies between two central banks, neither central bank having $8.01 trillion U.S. dollars and about €6 trillion equivalent to do so.

In doing so, each central bank essentially helped the other to print dollars and euros. Another nearly $1 trillion in dollar swaps was with the Bank of England, equivalent to nearly half of the United Kingdom’s GDP. The Federal Reserve printed dollars equivalent to 70% of U.S. GDP in 2008.

Voodoo Dollar-Euro Swaps Chart 1. Federal Reserve $8 Trillion in Dollar Liquidity “Loans” Swaps with the European Central Bank

TECHNICALLY, the Federal Reserve and the ECB did not swap $8.01 trillion dollars for euros at one time, as it would look somewhat problematic for the Federal Reserve Bank monetary system and the ECB because these trillions in dollars and euros do not exist. Continue reading