“A black hole is a region of spacetime where gravity prevents anything, including light, from escaping… Around a black hole there is a mathematically defined surface called an event horizon that marks the point of no return.”—Wikipedia

When Did QE Stop?

To much frenzied media coverage, the Federal Reserve Bank announced a third round of quantitative easing “QE 3∞“ on September 13, 2012. The Federal Reserve will essentially print unlimited quantities of dollars to purchase agency mortgage bonds and maintain nominal interest rates targeted at 0% (“ZIRP”) to keep borrowing costs reasonable for its member banks, among others.

“QE 3∞” in 2012 is the unlimited version of “QE 1” in 2009 following the banking and financial system crisis in September 2008. What does this mean?

QE is simply the printing of dollars in paper or digital form by the quasi-private Federal Reserve Bank, as the Federal Reserve does not have this money. In QE 1 (web), the Federal Reserve Bank printed $1.25 trillion to purchase agency mortgage-backed securities (MBSs). Agency MBSs are mortgage bonds (akin to a mutual fund filled with mortgages, peoples’ homes) issued and guaranteed or held by the quasi-private Fannie Mae and Freddie Mac.

On a practical level this means the Federal Reserve Bank printed $1.25 trillion with a computer stroke and became the owner or recipient of homeowners’ mortgage payments. The Federal Reserve will do this on an unlimited basis in QE 3 going forward, as it states ‘to foster maximum employment and price stability’.

What is it about the Federal Reserve Bank’s love affair with mortgage bonds that the media and the Federal Reserve will not speak of?

I. QE0: Insolvency of the Largest Banks in the Federal Reserve System

Let’s pause for a moment. The most significant QE was not even called QE. It was the suspension of the Financial Accounting Standards Board’s (FASB) mark-to-market accounting rule 157 in April 2009. The rule required banks to value assets on their balance sheets at current market price or fair value, but since 2009, became what the banks hope it is worth or what they paid for it.

Doing so helps insolvent banks avoid the appearance of insolvency by not having to write-down the amount of losses on assets, such as mortgage bonds, assuming there is a willing buyer (There isn’t really). Private sector financing for the housing market through demand for private label MBSs, which are mortgage bonds backed by mostly subprime mortgages reincarnated as prime issued and sold by the largest banks, collapsed since fall 2008.

Let’s give this FASB suspension of mark-to-market accounting event a name, QE0 , to mark the point of no return in April 2009 about six months after the banking and financial collapse in September 2008.

Following the collapse, lawmakers in the U.S. House of Representatives lined up to threaten FASB in a series of hearings to suspend mark-to-market accounting, as Representative Michael E. Capuano (D-Mass.) warned FASB’s chairman in March 2009: “Do not make us tell you what you have to do.” (Transcript of the U.S. House of Representatives Mark-to-Market Hearing, March 12, 2009). The American Bankers Association, Citigroup, and the Bank of New York Mellon Corp., the world’s largest custodian of financial assets, also pressured for the rule change (web).

[On a side note: MIT finance professor-CBO chief economist revised my memo to say that assets may already fully reflect market values. After I was fired I learned that MIT Professor Deborah Lucas called by the U.S. President to CBO in 2009 (web) has a CBO economist sit on FASB. This CBO economist and CBO Director Elmendorf are part of the Hamilton Project at the Brookings Institution. Robert Rubin is the project’s founder and Dr. Lawrence Summers, once chief advisor to the U.S. President, sits on its Advisory Council to promote economic growth and health care. Former Federal Reserve Bank Chairman Alan Greenspan, Robert Rubin, and Lawrence Summers were instrumental in the proliferation of derivatives in the late 1990s. ]

Let’s look at a few simple charts. What does QE0 FASB look like for the largest banks?

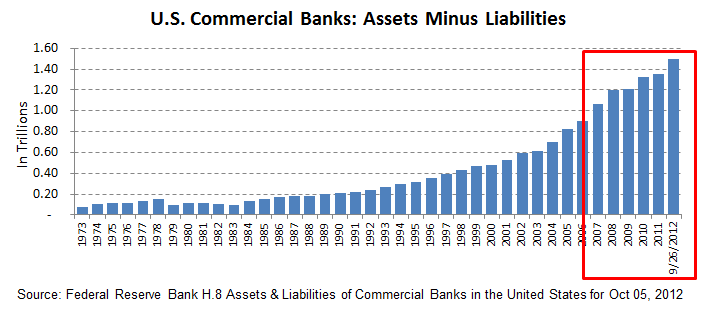

Voodoo Assets and Liabilities Chart 1:

From Voodoo Chart 1, was there a banking and financial crisis in 2008 that froze global markets? From the crisis in fall 2008 to 2009, there is no change between assets and liabilities! No change, for what has been considered the worst banking and financial crisis in a century (a few?). Continue reading