Continuing reports that banks are making it more difficult for their customers to remove their gold from the banking system, or a trading house getting its gold delivery as Germany faces a slight problem in its request to repatriate its gold being held at the Federal Reserve Bank of New York. There are also delivery problems of a different nature.

Recently I learned that a family member has been experiencing great, great difficulty in withdrawing their 401(k) funds for over a year now. I would like to share a few observations in case it helps to highlight the risks and issues with the 401(k) – worse yet, an unallocated 401(k) – that includes below, a notification and request for assistance in locating several individuals and why.

An unallocated 401(k) plan “co-mingles” or “pools”, i.e., combines individual employee 401(k) contributions into one 401(k) pool under the company name. One does not have dollars but “units” in the 401(k) pool that perhaps unbeknownst to many 401(k) contributors is an unallocated insurance annuity contract with an insurance company, and in this situation, with MetLife. The observations below speak to the individual risks, but more broadly since the 2007/2008 banking and financial collapse, this also means your 401(k) savings could approach zero ($0.00) should the insurance company fail (see posts on QE “printing money” and insolvent banking & financial system); this risk also applies to retirement or trading/stock accounts held at brokerage firms (link).

Whether allocated or unallocated, another unadvertised feature of 401(k)s in recent years is state and federal governments’ use of 401(k) withdrawals by the unemployed to disqualify them from receiving unemployment insurance “UI” benefits. Consider how many of the millions unemployed have learned the hard way that the exits have closed and what it means for their families, as others wait to find out. More in section II.

I. 401(k) Delivery Problems

I share my observations to highlight a sample of the issues one can encounter in terms of what happens to the 401(k) when a company is acquired or closes down, an increasingly common occurrence as indicated by the Small Business Administration data since 2007. The U.S. Department of Labor is monitoring the situation as it oversees enforcement issues and holds the repository on company-sponsored 401(k) plans. It seems many others around the country are in similar situations that are especially problematic at smaller companies.

1. You may be unaware that when a company closes or is acquired, federal law requires the 401(k) be closed and distributed to plan participants.

– The plan administrator (who may be the company VP and its general counsel) continues to keep the 401(k) funds at MetLife since 2009. After the company closes, the plan administrator may claim their responsibility ended.

Federal law requires plan administrator at the time of the company acquisition/closure to fulfill their fiduciary obligation over the 401(k) until the fund is closed and distributed to plan contributors (contributions returned to employees).

2. How quickly one loses access to the 401(k) account.

– Individual 401(k) statements may suddenly go dark. Online statements from ING showed a 401(k) balance of $0.00. For more than a year, you have no information nor access to your 401(k) account. Suppose 1,000 employees of a company experience this.

– You may receive no notification from ING nor MetLife nor the 401(k) plan administrator that your account “disappeared”. Why is ING involved? You may be unaware of the very fine print that ING provides your account statements for an un-named entity. For years, you may be unaware that MetLife “holds” your 401(k) and upon learning, they may not tell you who is the plan administrator.

This is a resource that provides public information about many company-specific 401(k) plans: http://www.brightscope.com/ .

(On a side note, MetLife “holds” the money but when ING stopped providing the statements ING sent the 401(k) money back to MetLife.)

– One may find that the more questions are asked about the 401(k) funds, MetLife and ING may become increasingly reluctant to answer questions [ING had a manager (legal counsel?) dictate to the client representative how to respond to your questions about your 401(k)].

– MetLife informs you that since your name is not on the 401(k) account, you (and other plan participants) are not authorized to request account statements nor access your 401(k) account – because you do not have one. That is because what you see in your on-line account statement is a digital entry of what you (think) have when ING provided reports and ING also states it can not ensure the accuracy of such figures. When the reporting went dark, you come to know that the true holder of the 401(k) account is the 401(k) plan administrator who has sole access and authority over the 401(k), even after the company closed.

(Consider the possibilities. In 2010 the U.S. Department of Labor created a criminal division to investigate and prosecute fraud and embezzlement of employee contributions in company-sponsored retirement and health plans, such as 401(k) trustees/administrators wiring employee 401(k) funds into their personal checking accounts, business accounts and a myriad other ways to defraud employee contributions. In other situations the U.S. Department of Labor obtains a court order to appoint a fiduciary to manage the 401(k) plan.)

3. You may request your plan administrator to withdraw your 401(k) funds.

–The company’s VP/general counsel also its 401(k) plan administrator may first say it is in progress for several months and then stop responding to e-mails about delays. Plan administrator may also retain an attorney to assist him in unlocking a disk from MetLife that contains information on employee contributions. You may not be sure what that means.

– After over a year as the plan administrator is encouraged to release the funds, it may take the plan administrator additional weeks to inform you that they do not have your mailing address.

So far, MetLife holds your 401(k) and the plan administrator has sole access to your 401(k), neither of whom has your address. That makes you a bit of a 401(k) third wheel.

4. The plan administrator may indicate he (she) is uncertain he has the authority to release the 401(k) funds.

– The VP/general counsel-plan administrator may be uncertain about his fiduciary obligations, but perhaps there is no uncertainty of his affinity to unallocated 401(k) insurance annuities with MetLife as he may be concurrently 401(k) plan administrator over another 401(k) with MetLife for another company where he is VP.

5. The 401(k) Closing Costs (“401(k) Hostage Ransom”)

– When the uncertainty subsides about his fiduciary obligation, the general counsel-plan administrator may inform you that in order to release the funds, he is assessing a closing cost fee that is equivalent to over 10% of the total value of the 401(k) pool that will be paid from the 401(k) pool. Suppose the total company 401(k) pool is $100,000. The plan administrator’s take would be $10,000.

If one makes significant contributions “units” to the 401(k) pool, one will pay that percentage of the “closing” costs. Had the 401(k) fund been closed when the company was acquired/closed, the cost to plan participants would have been about $0.00.

– At your request, the plan administrator may provide the 401(k) Summary Plan Description – the “401(k) SPD” that is very important to have when one least expects – that sure enough has language that plan participants will pay any costs to close the 401(k) fund.

In the case the SPD is an electronic file, you may wish to check the date when the SPD was created and modified as that language may not have existed because incidentally, the create and modified dates are stripped from the file. It reminds me of a similar experience at the Congressional Budget Office pertaining to a rather sensitive document from the assistant CBO director.

The Internal Revenue Service (IRS) requires companies to notify employees of any significant “material” change to the 401(k) SPD within 210 days of the end of the plan year.

6. You may ask the plan administrator questions about what happened to your 401(k) account and movements of money when your 401(k) ‘disappeared’.

– The plan administrator may retain an attorney who will charge you $250 an hour to answer questions or determine what information will be provided that will be billed to your 401(k) funds, in addition to the closing fees above. That is, the more questions asked about the 401(k) black hole, the more will be deducted from your 401(k).

7. You may also request a copy of your 401(k) statements since the account went dark.

– The plan administrator may also hire a 401(k) specialist who will charge $125 per hour to create the statements that will be billed to your 401(k) funds, in addition to the fees above. Since the plan administrator-attorney retained an attorney for himself, he may no longer communicate with you but only through the 401(k) specialist who consult with their attorney.

– Note the fact that the previous year’s statements need to be created indicates your 401(k) account statements do not exist. Recall that your funds have been pooled or combined with other plan contributors; at no time will plan administrator and his assistant (and their attorney) mention this.

How will you know your 401(k) is an unallocated insurance annuity? You do not.

If you are aware it exists, ask the plan administrator or look up your 401(k) at http://www.brightscope.com/. If these fields show “Insurance”, then your 401(k) is most likely an unallocated insurance annuity that incidentally has plan contributors paying the highest of plan management fees. Run. Run anyways.

– How many “units” of the 401(k) pool do you have? You may have no idea what “units” are because you thought you contributed dollars.

The only person who has that information is the 401(k) plan administrator, who may not have mentioned “units”. Perhaps few are aware that unallocated 401(k) accounts exists to ask about “units”. How are units calculated? Only the 401(k) plan administrator knows.

So far, estimated closing costs = 10% of 401(k) + $250 an hour attorney + $125 an hour for 401(k) statements.

Some people may pay what others characterize as this 401(k) “hostage ransom” due to not understanding the 401(k) and their lack of desire for you to understand the 401(k), and the expense of taking the plan administrator (or trustee) to court – Please know they know that.

8. During the 4 years when the 401(k) should have been returned to the employees, MetLife continues to collect fees for plan management/maintenance etc. of the 401(k) it “holds”; ING collects reporting fees; and Morgan Stanley collects “insurance and commission fees”. There may be other unreported or unknown fees known only to the 401(k) plan administrator and MetLife.

– These fees are taken out of your 401(k) funds. If you contribute more to the 401(k) pool, you will pay a greater percentage share of these fees.

On a side note, Morgan Stanley was bailed out in 2008 …its nearly $40 billion exposure to banks in France, explosion in derivatives activity… and Morgan Stanley is insuring MetLife (among the largest insurers in the world) with what capital…

– So far, you (and perhaps other plan contributors) may be the only one who does not want to be at this party but you can not leave, and it seems they will not let you leave.

– You may get the impression that every possible means of delays work to separate you from your 401(k).

9. Notification and Request for assistance.

We are now at about 1 ½ years later when the 401(k) account went dark.

– Generally all plan participants must sign-off on the release form to close and distribute the 401(k) funds; roll-overs are no longer possible once the company has closed. This means the distribution is delayed until former employees who contributed to the pooled 401(k) are found that is contingent on how motivated the plan administrator is to find them.

It has been about 4 years since the company was acquired and only recently did general counsel/plan administrator realize the funds must be returned to former employees.

If you are a former employee or know of one from LumenSoft Corporation who may still have their 401(k) account, please e-mail me using this contact form to help expedite the return of 401(k) funds to their rightful owners. LumenSoft Corporation was based in Minnesota and was acquired in 2009. LumenSoft’s former CEOs were David Nolby and Robert “Bob” Wallace in case you may recognize this company, and other senior management of the company who would like to assist your former employees to resolve this 401(k) issue.

Or as indicated by public information provided by brightscope.com, please notify LumenSoft’s former general counsel who is also the 401(k) plan administrator/sponsor, Richard B. Peterson, if you are a former LumenSoft employee who may still have 401(k) funds with the company as provided in the links below.

http://www.brightscope.com/form-5500/basic-info/558828//580168/Lumensoft-401k-Plan/2007/ and http://www.brightscope.com/form-5500/basic-info/217818/Meritide-Inc/221440/Meritide-Inc-401k-And-Profit-Sharing-Plan/2007/

UPDATE Aug. 21, 2013: Since this article was published yesterday, please note in the first brightscope.com link a change has been made so that the LumenSoft 401(k) plan information was replaced with another company (see attached). The new link (at least for the moment) is http://www.brightscope.com/form-5500/basic-info/558828//580168/Lumensoft-401k-Plan/.

The LumenSoft Corporation 401(k) (pdf), regardless of where that link goes.

The Form 5500 filing shows Richard B. Peterson as being 401(k) plan administrator and vice president simultaneously for two companies, LumenSoft Corporation and Meritide Inc. Records show he listed himself as CEO of Lumensoft after it was sold and no longer an active company; the situation seems a bit ambiguous. Perhaps you can contact him at both locations as both LumenSoft and Meritide 401(k) plans are registered to his name under the same address.

II. State & Federal Govt.: 401(k) Withdrawal Disqualify for Unemployment Insurance Benefits

In recent years, the public may be unaware that 401(k) withdrawals can disqualify them from unemployment benefits insurance. In states such as Colorado an unemployed person’s 401(k) withdrawals can disqualify them for receiving unemployment insurance benefits — with an interesting stipulation. Perhaps it is best conveyed by someone who was unaware the exit for him had closed:

“I never dreamed I’d have to have unemployment some day,” he said.

When he applied for Colorado’s unemployment insurance benefit, he missed the fine print that stipulated in the event he withdrew from his 401(k),

That is, in order to keep your unemployment benefits you must put your money back into the financial system or in other states, UI is reduced in some proportion to 401(k) withdrawals. One interpretation is the state wants to protect private retirement savings because of its concern for the people. A quick check shows this makes sense because the average unemployment insurance benefits in mid-2011 was $1,200 a month when the average family spends nearly $1,400 per month just on housing. That leaves Ma and Pa and the young’uns rather destitute to face issues such as home foreclosure, insurance, sending their kids to college (which after 4-5 years of college debt, 62% of graduates will be underemployed CNN link), etc. Since the 2007/2008 financial system collapse, the real unemployment rate continues to rise as wages turn lower and jobs more temporary. Behind Wal-Mart is the nation’s second largest employer, Kelly Services, a temporary work provider.

[Families gone from the middle class but the official statistics look great though. The widely reported official U3 unemployment rate ignores long-term discouraged workers who were ‘defined out of existence’ from the calculations since 1994 under the Clinton Administration; these millions of people are in ShadowStats alternate calculations.]

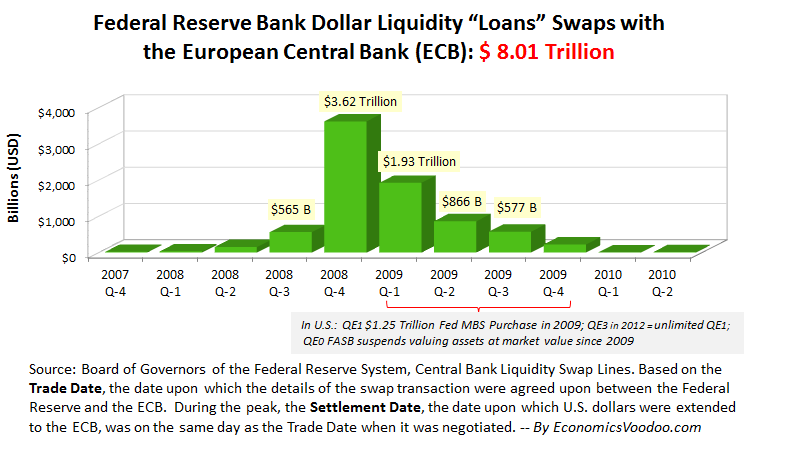

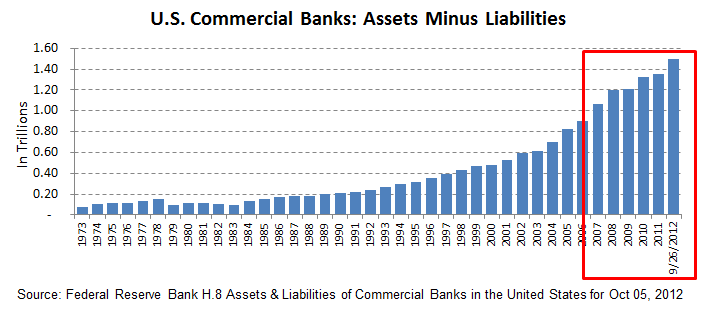

So, why are the unemployment insurance benefits laws written to force people to remain in the financial system? Consider that the $3.6 trillion in 401(k)s are the aggregate savings of the American public that is controlled by the largest banks on Wall Street and the financial institutions that collapsed in 2007/2008 but for the levitation above The Black Hole through various mechanisms… including your 401(k). “QE” quantitative easing, i.e., money printing is infinite but time is finite. [I am told of some people who traveled to Japan a few months ago that $100 U.S. dollar bills were not accepted.]

Perhaps after relieving the American public 40% of your net wealth (OTC derivatives) – mostly your home equity – the Federal Reserve Bank’s largest banks (its owners) and financial institutions are going in for your last lifeline:

- “KKR to Carlyle Target $3.6 Trillion in 401(k)s Accounts.” Bloomberg Apr 4, 2013.

- “Big Banks Go After 401(k) Trillions.” BloombergBusinessweek Mar 11, 2011. “It’s one of the top priorities” at JP Morgan Chase.

- PBS’s Frontline series in April 2013 on 401(k)s featured “The Retirement Gamble”, segments which include “Why the 401(k) is a ‘Failed Experiment’” and “The ‘Train Wreck’ Awaiting American Retirement”.

“What do I do with the money if I close out my 401(k)?” Save in the same form outside the financial system as what is guarded in the vaults of the central banks and under the protection of military bases at Fort Knox (“Yes, it is true: Gold is dead”) and West Point: official U.S. gold holdings. The Federal Reserve Bank’s largest banks, financial institutions and the media may not like it because your money is out of their reach.