The European Union (EU) “Dream” Wasn’t Even European (More Preview to Part II Ideological Subversion of the United States)

Recently, European Commission President Barroso expressed concerns that the European “dream” was under threat from a “resurgence of populism and nationalism.” The “threat” of Italy, Poland, Spain… resurging as sovereign nations? To the EU creators, yes, because the European Union “dream” wasn’t even European.

In September 2000 about two years after the euro became the official currency of the Eurozone, the Telegraph foreign press (link) reported DECLASSIFIED U.S. government documents from the 1950s and 1960s showed U.S. intelligence ran a campaign to advance a ‘united’ Europe, exert pressure to push Britain into the European state. In 1948 the American Committee for a United Europe (ACUE) was created that funded and directed the European federalist movement and covert operations in the European Youth Campaign (“Euro-federalists financed by US spy chiefs.” Telegraph Sept 19, 2000). One memorandum dated July 26, 1950, gives instructions for a campaign to promote a European parliament, signed by General William J. Donovan, head of the American wartime Office of Strategic Services, precursor of the CIA.

Another memo dated June 11, 1965, advises the vice-president of the European Economic Community, Robert Marjolin, to secretly push for the monetary union and suppress debate until “adoption of such proposals would become virtually inescapable.” The ACUE that funded these activities was funded by the Rockefeller Foundation and Ford Foundation.This followed the end of World War II as it was the same wealth behind these Foundations that funded and unleashed Hitler and the “Master Race” upon Europe. Over 400,000 U.S. military men and women died in World War II; total estimated 60-80 million deaths including civilians. One U.S. attorney general at the time used the term “treason”.

For the sake of your nation leave the euro, EU.

In the interests of the United States? As a preview to Part II Ideological Subversion, the Rockefeller Foundation and Ford Foundation together with the Carnegie Endowment were under congressional investigation for their funding subversion of the United States. Confirmed communist spy Alger Hiss was president of the Carnegie Endowment and David Rockefeller joined the Board at his “invitation”. One of the documents found at the Foundation in the early 1900s was their plan to take control of the U.S. State Department. The timing of the design to corral nations in Europe into the EU commenced as several generations in the United States had been deliberately “dumbed-down” and subverted by the 1960s to Marxism-Leninism, the ideology of communism with fascism at the top. In the upcoming Part II, consider who assailed and halted the investigations. Yuri Bezmenov (Part I Ideological Subversion) Soviet subversion expert-turned defector warned U.S. intelligence, politicians and the media and realized he was talking to people who wanted to prevent the American people from understanding the truth (video).

Consider the parallel plunder of the United States and the Eurozone countries in Run Cyprus! Leave the Euro. Consider that what was put forth to the people – the euro – as integration of the European economy was subverted to control.

“Who does what, who decides what, who controls whom and what? And where are we heading to?”—Barroso in earlier quote on April 23, 2013. It seems the answers to these question were designed some 60 years ago as its true intent leaks out from time to time. In 1992 Strobe Talbott, former President Clinton’s Deputy Secretary of State and current member of the Council on Foreign Relations and President of the Brookings Institution, wrote in Time Magazine: “Nationhood as we know it will be obsolete; all states will recognize a single, global authority…” (“America Abroad: The Birth of the Global Nation.” July 20, 1992).

There it is: Aspirations for the “One World” Order, the “single global authority” or as Bezmenov revealed “world domination”. No Mexico. No Spain. No Indonesia. No Australia. No Poland. No France. No Ukraine. No Italy. No Turkey. No India. No Pakistan. No Malaysia. No U.K. No Iran and so on…Nationhood obsolete. Just states asking permission from the ‘single global authority’ to retain some rights. Kissinger expounds on the virtues of this ‘single global authority’ in 2009.

No China? No Russia? It seems there was a minor miscalculation.

The largest contributors to the Brookings Institution are the same Ford Foundation and Rockefeller Foundation, Bill & Melinda Gates Foundation, and John L. Thornton. Thornton is the Brookings Chair of the Board and former President and co-CEO of Goldman Sachs. The Brookings Institution is also where Robert Rubin and Lawrence Summers – with former Federal Reserve Bank Chairman Alan Greenspan – who were instrumental in the proliferation of derivatives that collapsed the U.S. economy gather to promote economic growth.

Goldman Sachs is co-founder of the Council on Foreign Relations (CFR, Robert Rubin its co-chairman). Otmar Issing, co-creator of the euro is International Advisor of Goldman Sachs. Rubin, Summers, Greenspan, along with Goldman Sachs’s CEO Lloyd Blankfein, JP Morgan Chase’s CEO Jamie Dimon, Zbigniew Brzezinski of the Grand Chessboard designs on Europe, and U.S. Treasury Secretary Timothy Geithner congregate at the CFR with five Rockefellers (whose Chase acquired JP Morgan, shareholder-owner of the Federal Reserve Bank); also CFR members are former CEOs of Fannie Mae and Freddie Mac (Daniel Mudd, Richard Syron respectively; Frank Raines of Fannie Mae) and Maurice “Hank” Greenberg of AIG – heads of three institutions at the heart of the 2008 collapse.

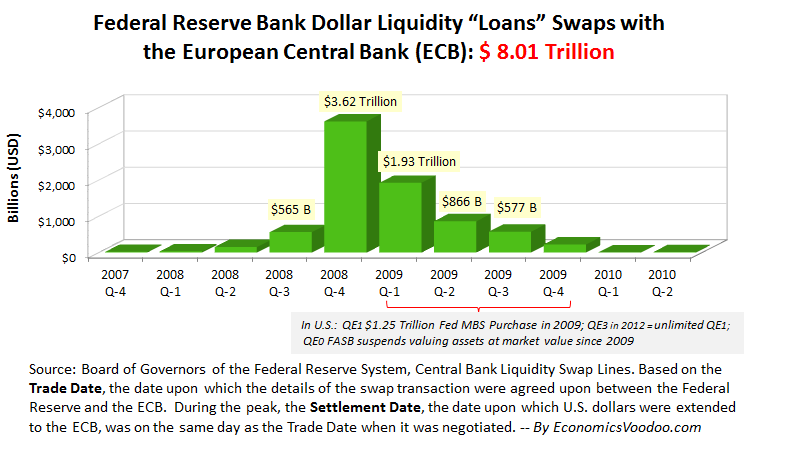

It appears the CFR has the greatest concentration of the worst failures in the history of the United States, the collapse of its financial system, or its most successful depending on the vantage point. In the previous article, “The Federal Reserve Bank is Naked,” consider in the 2009 QE I mortgage bond purchase program how it is possible that the Federal Reserve Bank paid a handful of its banks $57.7 billion for a $600 million mortgage bond from the 1980s and multiple other similar FRB bond purchases that totaled $1.25 trillion. U.S. State Department Secretary Clinton-U.S. presidential candidate expressed their fortunate proximity to the CFR building as that is where the Department obtains U.S. foreign policy (video), presumably with assistance from Henry Kissinger wielding U.S. military men as “dumb, stupid animals to be used” as pawns for foreign policy (Woodward & Bernstein. (1976). The Final Days, p.194).

From their financing and buildup of the Soviet Union to Hitler’s Third Reich takes us to Bechtel’s build-up of China since the 1950s (see footnote on Hegelian dialectic below), that brings up a curious case at Los Alamos National Laboratory in the late 1990s. In Part II we look at their interests in Russian and Asian art and culture (with AIG’s CIA-esque Maurice “Hank” Greenburg), and an interesting battle over oil that revealed a rather epic Who’s Who of the “One World.” Much has been written about the revolving door between Wall Street and the SEC, the White House and the State Department but perhaps that should be extended to the CIA.

The Telegraph reported the World Gold Council advises Italy to hand over its gold reserves to force a change in EMU policy (“Italy should use its gold reserves to force a change in EMU policy.” Telegraph May 2, 2013).

In place of gold, are Italy, Portugal, Spain…perhaps dusting off those guillotines?

[Economics Professor Antony Sutton (1976. Wall Street and the Rise of Hitler) suggested 90% of the Council on Foreign Relations is an outer ring composed of “hangers-on and social climbers”, perhaps the equivalent to what Soviet KGB subversion expert Yuri Bezmenov calls “useful idiots” [Part I Ideological Subversion of the United States]. The CFR members include a Who’s Who of economic academia, whose American Economic Association was annexed to their creation of the Federal Reserve Bank, which Sutton observed has produced more “bootlickers” than researchers. For what Sutton uncovered in declassifying State Department records and research at Stanford University, he faced pressure from the White House, told by Glenn Campbell, President Reagan’s advisor over the CIA, that he was a “problem” and his academic career “you will not survive”.

Sutton traced their roots back to Georg Wilhelm Friedrich Hegel, the German philosopher for State supremacy or Fascism, whose ideas inspired Hitler as well as Karl Marx and Friedrich Engel’s The Communist Manifesto. The enamored wealthy imported this to the United States and financed its propagation, which takes us to Part II…

Their Hegelian dialectic creates conflict, pits countries against the other while financing and controlling the process, and out of destruction and “crises” consolidate control. It is how conflict is created between the left and right in the United States to keep the masses preoccupied while controlling the parameters of conflict and thus the outcome, always towards more State control.

In Part II, consider which Ivy League university in the United States was the reputed “nursery for communism” that required naked photos of its freshmen from which a core of its establishment went on to create and fund ideas of the “Master Race” that led to the sterilization of 60,000 “defective” Americans even before Hitler’s gas chambers, to financing his Third Reich, subversion of the U.S., the creation of EU, initiated wars in Iraq, Afghanistan …. ]. The plunder…

Bank Deposits Confiscation in the United States – The Cyprus Blueprint Implemented

Update to the previous article, Run Cyprus! Leave the Euro (April 1, 2013). The Telegraph foreign press reported on April 28, 2013 (link) that Bank of Cyprus has implemented the depositor “bail-in”:

“Bank of Cyprus said it had converted 37.5pc of deposits exceeding €100,000 into “class A” shares [In exchange for depositors not getting their money, depositors are given stocks of the bankrupt bank], with an additional 22.5pc held as a buffer for possible conversion in the future…Another 30pc would be temporarily frozen and held as deposits, the bank said [Depositor can not take money out].”

The Irish Times reported €4.2 billion in customer deposits was raided (link). The “bail-in” is along the lines outlined in a joint paper by the FDIC and Bank of England in December 2012 titled, “Resolving Globally Active, Systemically Important, Financial Institutions” and other documents that suggests several years in planning.

The U.S. media has remained rather silent on what is being planned for the American public. When the time comes, money left in the banks will be taken, as now bank depositors have become unsecured lenders to the banks; 401(k) and other retirement plans are in line. Take GDP and subtract the trillions in QE and The Black Hole reveals itself – it is not complicated. There is no solution to the debt and OTC derivative problems, assuming a solution is the objective.