“This [U.S. Constitution] is likely to be well administered for a course of years and can only end in Despotism… when the people shall become so corrupted as to need despotic government, being incapable of any other.”

“This [U.S. Constitution] is likely to be well administered for a course of years and can only end in Despotism… when the people shall become so corrupted as to need despotic government, being incapable of any other.”

– Benjamin Franklin, Founding Father (81 years of age), Speech at the Signing of the Constitution of the United States on September 17, 1787.

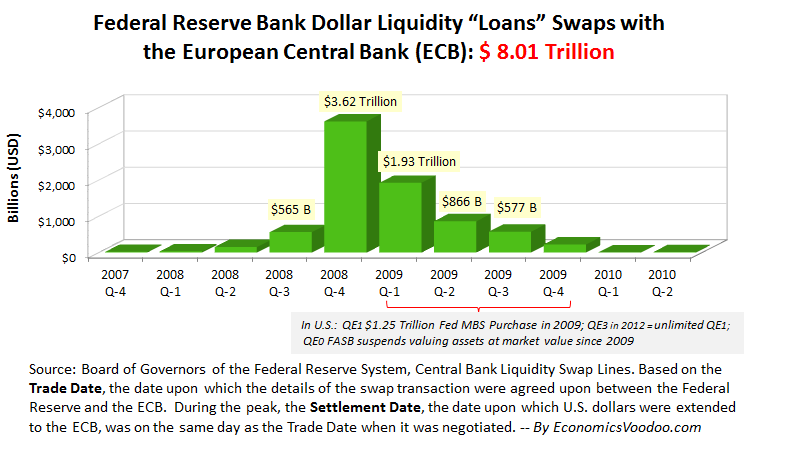

I have not written about “fiscal cliff” or debt ceiling issues. The data is simple: there is no feasible economic growth to solve these problems and more so, tied to over $1,000 trillion in OTC notional derivatives (imaginary money) embedded in the quasi-private Federal Reserve Bank’s largest member banks and financial institutions that have been suspended from the black hole since 2008. The Federal Reserve Bank’s printed $20 trillion+ over that period (The Federal Reserve Bank’s Love Affair in QE 0-1-2-3∞, The Federal Reserve Bank is Naked, Beyond QE) is not enough for its member banks as the authorities are looking to help “manage” (protect) Americans from their $19 trillion in retirement savings accounts. It seems an ideal environment. Before a few fall off their chairs, it can be useful to look beyond chart movements as the truth leaks out from time to time for some time.

First, I would like to share a monetary experience not found in Ph.D. economics. After the communist North Viet Nam took over the more free and prosperous South in 1975, the communist government “State” confiscated all the guns (and priests). After an interlude, the State introduced without warning a new currency that took immediate effect. Gold disappeared. People were allowed to exchange a certain amount of old currency for the new currency to “equalize” everyone – control an unstated purpose and the State wanted to know who had what. What people could not exchange became worthless paper. There was panic, pandemonium as people furiously spent the old currency on food and goods, pushing up prices; our produce could not keep up with demand. Those with cash below the exchange limit took the old currency, but that did not solve the problem of inflation and another currency revaluation. People with gold (few put anything in banks) were insulated from these changes and preserved some independence from the State. Sociologist Vu Duc Vuong explained the Vietnamese’s centuries-old attachment to gold, “Empires may fall, currencies may change… gold will always survive.”

Indoctrination was constant. To protect the population, the communists shot people who fled the country to prove the dangers of having a gun. The State had a “see something, say something” program where their informers reported back suspicious activity in the neighborhood. Poor Mom was reported to the State when she sold our pool table because the cash could be used to fund terrorism against the State, such as to feed the family. The State was also concerned about our diet and dropped by to see what we were eating in case the food differed from what the collective ate. To protect us from leaving the communist paradise, the State visited to ensure we were safe. As a shared sacrifice, the State asked to borrow our home permanently, never mind that we lived there. They took it over when we disappeared.

The village elders have a saying that is translated as: “Hide the hand that throws the stone.” It may be that it is a hand that plays all sides, loyal to no nation or peoples.

I. Ideological Subversion, Psychological Warfare: (Back) Into the Lion’s Den

Ideological subversion or psychological warfare is a “process which is legitimate, overt… to change the perception of reality of every American to such an extent that despite the abundance of information no one is able to come to sensible conclusions in the interest of defending themselves, their families…their country… [E]xposure to true information does not matter anymore. A person who is demoralized is unable to assess true information. The facts tell nothing to him.”

“[P]romise people all kind of goodies and “paradise of earth”, to destabilize your economy, to eliminate the principal of free-market competition and to put a “Big Brother” government… In other words, Marxism-Leninism ideology is being pumped into the soft heads of at least three generations of American students without being challenged or counterbalanced by the basic values of Americanism, American patriotism…”

“[I]ndividuals who were instrumental in creating public opinion: publishers, editors, journalists, actors, educationalists, professors .. business circles… would be promoted to positions of power through media and public opinion manipulation… large circulation, established, conservative media…filthy rich movie makers, intellectuals, so-called academic circles. Cynical, ego-centric people…are the most recruitable people, people who lack moral principals, who are either too greedy or suffer from self-importance…”

“The result? The result you can see. Most of the people who graduated in the ‘60s, drop outs or half-baked intellectuals are now occupying the positions of power in the governments, civil service, business, mass media, educational system… They are contaminated.”

“The demoralization process in the United States is basically completed already for the last 25 years. Actually, it’s over fulfilled… United States is in a state of war. Undeclared total war against the basic principals and foundations of this system. And the initiator of this war is not comrade Andropov [Head KGB].” – Yuri Bezmenov, KGB Subversion Expert, Soviet Defector excerpts from 1984 Interview.Transcript further below. (1 Hour Interview Full Version)

Yuri Bezmenov was perhaps aware more than most that a few notable Wall Street banks and their founding of their quasi-private Federal Reserve Bank, and U.S. industrialists-corporations (Ford, GE, Rockefeller’s Standard Oil…) financed among others, communists of the Bolshevik Revolution later renamed Communist Party of the Soviet Union in 1952, building up the Soviet Union whose weaponry was later used against U.S. soldiers and the Vietnamese in the South during the Viet Nam war. These financiers backed both Franklin Delano Roosevelt and Hitler’s Nazi rise into the profits of World War II that gave birth to a set of twins, the New Deal and the New Order. The financiers, FDR, Hitler and Mussolini shared mutual admiration for State control and low regard for free markets.

By the 1930s

In an interview with the New York Times on June 4, 1933 Premier Mussolini praised, “President Roosevelt’s new plan for coordination of industry follows precisely the lines of Fascist cooperation… Continue reading →

In 1956, the Chicago Daily Tribune’s Washington bureau chief reported Fort Knox vaults $12.843 billion in gold, which at the standard 400 oz. bar and $35 per ounce at the time would be equivalent to 10,400 metric tons, or at the official price of $42.22, about 8,620 metric tons. Fort Knox held slightly over half of the $21.8 billion gold holdings in the United States, half of the gold foreign-owned. In 1962 half a billion dollars of gold at Fort Knox was moved to an undisclosed location (“U.S. Taps Gold Supply Stored in Fort Knox.” Chicago Daily Tribune Aug 18, 1962). In July 1966 the Chicago Tribune’s chief again reported $11 billion in gold was withdrawn from Fort Knox, some of which could have been purchased by private hands – suppose at the official price of $42.22, that would be slightly under 7,400 metric tons; Switzerland alone took $1 billion (“U.S. Finances Gold Raids at Fort Knox.” July 22, 1966).